In this post we’ll be explaining how you can invest in the S&P 500 Shariah Index including the easiest ways to own the index and track your investment.

Disclaimer: The information in this article does not constitute any form of financial or investment advice by InvestingMuslim.com

Depending on whether you are based in the United States or the UK / EU there will be some slight differences in how you can gain exposure to the S&P 500 Shariah Index.

How To Invest In The S&P 500 Shariah Index

If you are based in the US you can invest in the S&P 500 Shariah Index via the SP Funds S&P 500 Sharia Industry Exclusions ETF listed on the NYSE under ticker symbol SPUS.

The SP Funds S&P 500 Sharia Industry Exclusions ETF seeks to track the performance of the underlying S&P 500 Shariah Industry Exclusions Index and has a management fee of 0.49% per annum.

You can purchase this ETF as a retail investor via most online brokers as it is listed on the NYSE.

As this ETF is US domiciled it won’t be directly available to retail investors based in the UK or the EU.

So how can you invest in the S&P 500 Shariah Index if you are based in the UK or the EU?

The answer in short is to consider the readily available Islamic index ETFs targeted to European investors with significant US exposure.

We’ve done the work in reviewing them and the iShares MSCI USA Islamic UCITS ETF (ticker symbol ISUS LN) provides the largest exposure to US listed Sharia compliant securities.

The iShares MSCI USA Islamic UCITS ETF seeks to track the performance of the MSCI USA Islamic Index which is composed of large and mid cap US stocks that adhere to the Shariah principles.

Let’s quickly breakdown the key stats for both of these ETFs to help you make a better informed decision;

| ETF | Exchange | Ticker Symbol | Underlying Benchmark | Management Fee | Available in EU? |

| SP Funds S&P 500 Sharia Industry Exclusions | NYSE | SPUS | S&P 500 Shariah Industry Exclusions Index | 0.49% | No |

| iShares MSCI USA Islamic UCITS ETF | LSE | ISUS LN | MSCI USA Islamic Index | 0.5% | Yes |

Later in this post we will compare both the S&P 500 Shariah Industry Exclusion Index and MSCI USA Islamic Index to gauge how similar they are to each other.

We’ll now go further in depth into the process of investing in the S&P 500 Shariah Index for both US and EU based investors along with a working example explaining the costs, payouts and other important things to consider. After reading the next section you should have a complete understanding of how to invest and gain exposure to the S&P 500 Shariah Index

A detailed guide on how to purchase S&P 500 Shariah related ETFs for both US and EU retail investors.

Choose And Set Up A Brokerage Account

Before we purchase anything we will need to set up a broker account to gain access to the ETFs.

Setting up an online brokerage account is now fairly easy and there are numerous providers online, below are some of the leading online brokerage platforms, all will allow you to access Islamic investment products:

For US based investors:

- TD Ameritrade

- Fidelity

- Charles Schwab

- Interactive Brokers

For UK based investors:

- Saxo Markets

- AJ Bell

- Hargreaves Lansdown

- Interactive Investor

Take the time to review the different online brokerage platforms, in particular review their costs and fees prior to signing up.

Typically you will need to transfer the funds you want to invest alongside additional funds to cover the cost of transaction to your brokerage account.

Once you’ve set up your brokerage account and transferred funds over simply search for the ETF you want, either via the ticker symbol or the name of the ETF we’ve mentioned.

For example if we wanted to purchase the SP Funds S&P 500 Sharia Industry Exclusions ETF we’d simply search the ticker symbol SPUS within our brokerage platform and once we’re ready to invest hit buy. That’s it. You’ve gained exposure and invested in the S&P 500 Shariah index via an ETF!

UK/EU investors need to consider an additional FX charge when purchasing the iShares MSCI USA Islamic UCITS ETF as it is priced in USD.

Sector Breakdown Comparison

Now let’s quickly compare the two underlying benchmarks for both of these ETF’s and see how similar they are

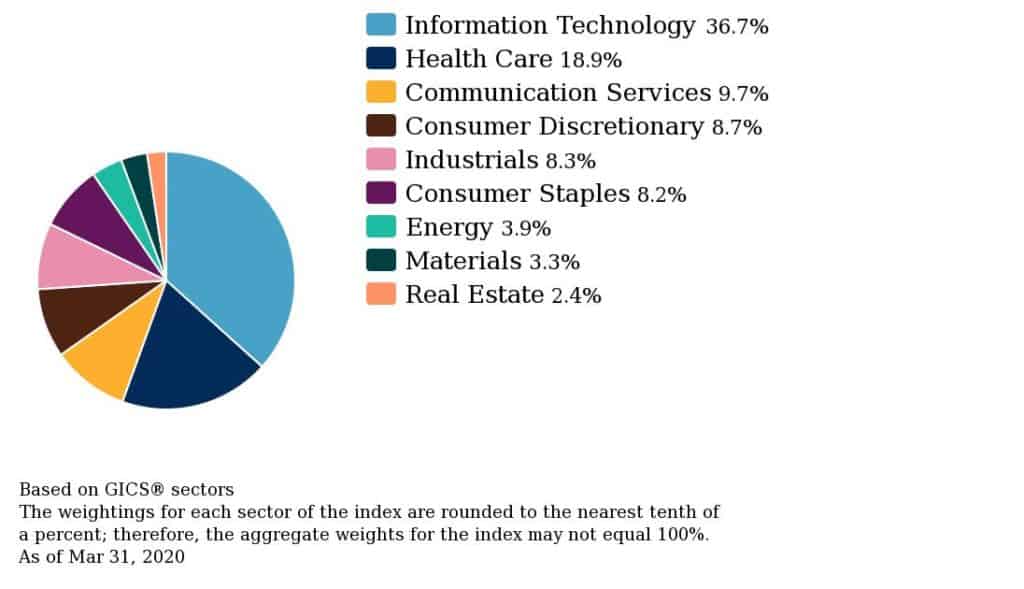

S&P 500 Shariah Industry Exclusions Index

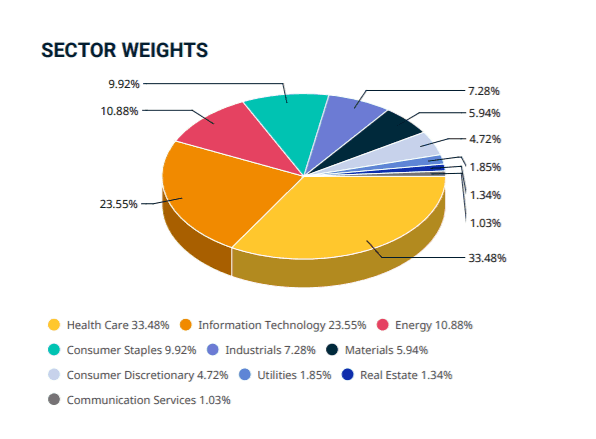

MSCI USA Islamic Index

As you can see both underlying benchmarks are fairly similar in terms of sector weightings.

Performance Comparison

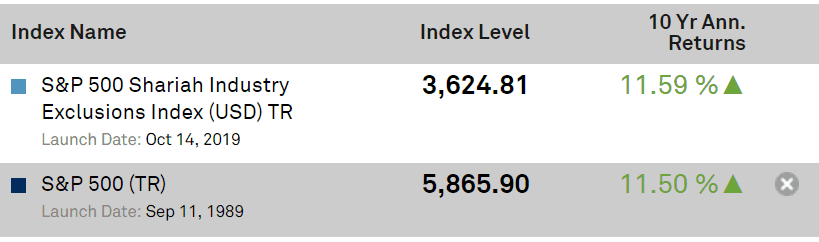

Now let’s move onto comparing the annualized returns for the S&P 500 Shariah Index against the conventional S&P 500 Index from 2009 – 2020:

As we see the S&P 500 Shariah Index has slightly outperformed the conventional S&P 500 Index from 2009-2020!

Remember Shariah forbids heavy debt leverage and conventional banking businesses which had a tough time during the global financial crisis.

So that’s it, you should know be fully equipped with the knowledge on how to invest in the S&P 500 Shariah and it’s close benchmarks via ETFs.